In a groundbreaking study, MIT researchers alongside industry experts have unveiled a comprehensive strategy to revolutionize the solar energy landscape through perovskite solar cells. These innovative materials, despite showing tremendous potential to outperform traditional silicon-based photovoltaics, have struggled to penetrate the established solar market. The new research provides a strategic pathway for this promising technology to transition from laboratory experiments to becoming a major player in the global renewable energy sector.

The detailed technoeconomic analysis reveals a brilliant market entry approach: targeting premium specialized applications first, then gradually expanding into broader markets. This strategy enables solar panel manufacturers to circumvent the massive initial capital investments—potentially hundreds of millions or even billions of dollars—that would be required to immediately compete with silicon-based panels in large-scale utility installations. Instead, the research demonstrates that starting with specialized applications could be achieved with a more manageable initial investment of approximately $40 million.

Published in the prestigious journal Joule, the research was conducted by MIT postdoc Ian Mathews, research scientist Marius Peters, mechanical engineering professor Tonio Buonassisi, along with five additional experts from MIT, Wellesley College, and Swift Solar Inc.

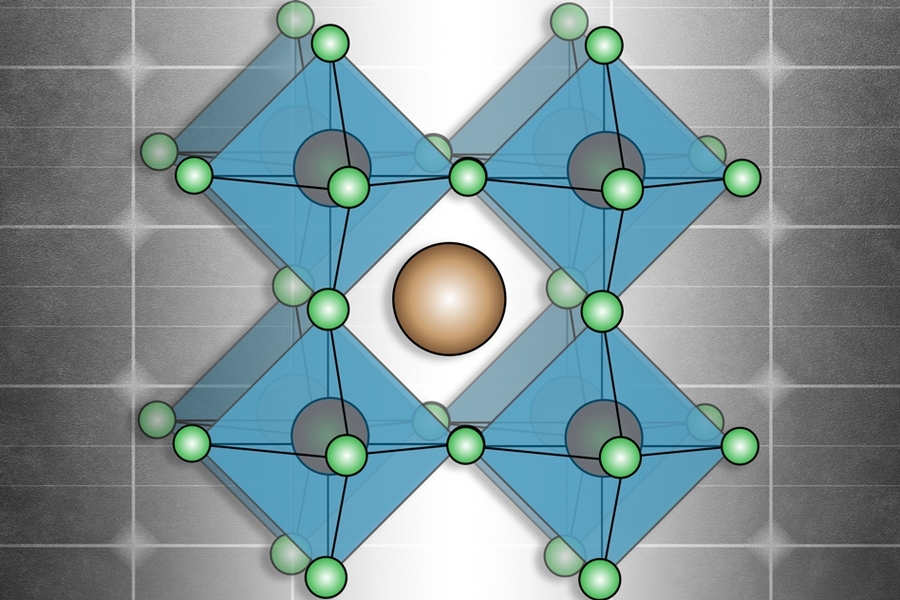

Perovskite-based solar cells—comprising a broad category of compounds with a distinctive molecular structure—offer revolutionary advantages for solar installations. Their raw materials are cost-effective, and they can be manufactured using a roll-to-roll process similar to newspaper printing, applied onto lightweight, flexible substrates. This manufacturing approach could dramatically reduce transportation and installation expenses, though further development is needed to enhance their long-term durability. While various promising solar cell materials are being developed worldwide, none have yet successfully entered the commercial market.

"Numerous new solar cell materials and companies have emerged over the years," explains Mathews, "yet despite these innovations, silicon continues to dominate the industry, maintaining its position for decades."

What explains this persistent dominance? "One significant barrier for new technologies has always been the enormous capital required to construct large-scale manufacturing facilities," Mathews notes. "Startups face what's known as 'the valley of death'—the challenge of securing the tens of millions of dollars needed to reach a scale where their technology becomes profitable in the broader solar energy marketplace."

However, Mathews highlights several specialized solar applications where the unique characteristics of perovskite-based cells—their light weight, flexibility, and potential transparency—offer substantial advantages. By initially focusing on these niche markets, a startup solar company could scale up gradually, using profits from premium products to progressively expand production capabilities.

Reviewing existing literature on perovskite solar cell development, Mathews observes, "Researchers claim remarkably low costs, but these projections assume factories have already reached significant scale. We've witnessed this pattern before—promises of new photovoltaic materials that will be cheaper and superior to all alternatives. While exciting, we need practical strategies for scaling these technologies from laboratory to commercial viability."

"Our approach was unique," Mathews continues. "We modeled manufacturing costs as a function of scale. If you're operating with just ten people in a small facility, what price point must you reach to achieve profitability? And once you achieve full scale, how cost-competitive can your product become?"

The analysis confirmed that attempting to directly enter the rooftop or utility-scale solar markets would require substantial upfront capital investment. "Instead, we examined pricing in specialized markets like the Internet of Things or building-integrated photovoltaics," Mathews explains. "These markets typically command higher prices because they serve specialized needs. Customers will pay premium prices for flexibility or modules that seamlessly integrate into building designs." Other promising niche applications include self-powered microelectronic devices.

Such specialized applications enable market entry without massive capital requirements. "This approach reduces required investment from tens or hundreds of millions to just a few million dollars, dramatically accelerating the path to profitability," Mathews emphasizes.

"This strategy allows companies to validate their technology—both technically and commercially—by actually building and selling products that perform reliably in real-world conditions," Mathews explains. "It also demonstrates manufacturing capabilities at specific price points, building credibility with investors and customers alike."

Several startups are already working to commercialize perovskite solar cells, though none have yet brought products to market. These companies have adopted various approaches, with some implementing the gradual growth strategy outlined in this research. "Oxford PV, which has secured substantial funding, is developing tandem cells combining silicon and perovskite to enhance overall efficiency," Mathews notes. "Swift Solar, co-founded by paper co-author Joel Jean PhD '17, focuses on flexible perovskite applications. Meanwhile, Saule Technologies is exploring printable perovskite technologies."

Mathews suggests that the technoeconomic analysis methodology employed in their research could be applied to numerous other emerging energy technologies, including rechargeable batteries, energy storage systems, and alternative solar cell materials.

"Many academic studies examine manufacturing costs at scale, but few analyze the cost structure at small-scale production or identify factors affecting economies of scale," Mathews observes. "This approach could be applied to many technologies, potentially accelerating the journey from laboratory innovation to market implementation."

The research team included MIT alumni Sarah Sofia PhD '19 and Sin Cheng Siah PhD '15, Wellesley College student Erica Ma, and former MIT postdoc Hannu Laine. The work received support from the European Union's Horizon 2020 research and innovation program, the Martin Family Society for Fellows of Sustainability, the U.S. Department of Energy, Shell through the MIT Energy Initiative, and the Singapore-MIT Alliance for Research and Technology.